Colby Hamilton appears in the following:

Watch: Senate and Assembly Now in Session

Wednesday, December 07, 2011

Updated: The Senate and Assembly special sessions are now underway, and you can play along at your desk!

To launch a (Real) player of the Assembly, click here, and you can watch a live-stream of the Senate here.

Liz Benjamin got a hold of the official proclamation below. As Liz points out, it's uncertain (trying to find out now) if the bill has even been printed yet.

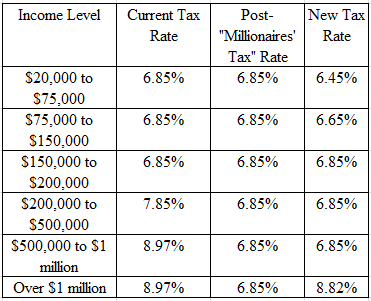

Tax deal numbers for individual filers reveal a true millionaires' tax

Wednesday, December 07, 2011

OK, since we found out late yesterday that the numbers the Governor put out were actually for joint filers, I've put together what they'd look like for single filers. (Thanks, again, to Jimmy Vielkind forproviding the raw numbers here.)

In a sense, the tax change will be a true increase on those individuals making more than $1 million a year. Basically the final numbers look very similar to the plan floated by Assembly Speaker Sheldon Silver to replace the current upper-income tax surcharge that you see below with a higher, permanent tax on wealthy New Yorkers.

Again, as it stands today, yes, the Governor and legislative leaders are in fact lowering taxes for everyone. But without this reconfiguring, you'd have a drop back to levels that everyone--regardless of which bracket--would had in 2009, a tax break for everyone making $200,000 a year or more.

Now, those making up to $150,000 get a break at the expense, in some ways, of those making $1 million a year or more. In other words, New York State will now have a true millionaires' tax.

'The Capitol Pressroom' with Susan Arbetter

Wednesday, December 07, 2011

Today on "The Capitol Pressroom":

Today on "The Capitol Pressroom":

Assemblyman Joseph Morelle, D-132nd District - parts of Rochester, and the towns of Irondequoit & Brighton – chairs the Standing Committee on Insurance and sits on the Rules and Ways and Means committees. He will join us in the studio to discuss this afternoon’s special session, as well as the possibility of a constitutional amendment on casino gambling.

Frank Mauro of the Fiscal Policy Institute weighs in on the three-way tax restructuring deal announced by Governor Cuomo & Legislative leaders yesterday.

Cathy Kenny of the American Petroleum Institute compares the Empire State's due diligence around hydrofracking, to that of other states.

And even as opponents of New York's same sex marriage law win a round in court, Robert Freeman of the State's Committee on Open Government isn't convinced that the Governor violated the state's open meetings law by conducting closed meetings to court GOP supporters in advance of the vote.

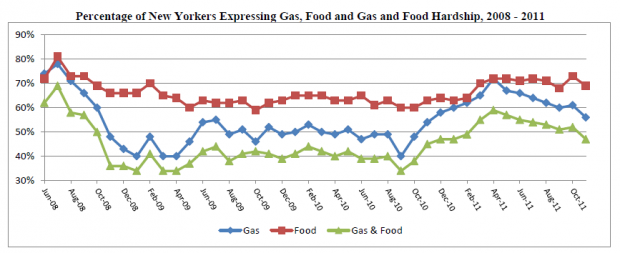

New York consumer confidence grows, but stays below this time last year

Wednesday, December 07, 2011

New York voters are looking on the brighter side of life, according to a new Siena Poll released this morning. Confidence rose by 3.1 points in November, with national confidence rising slightly higher at 3.2 points.

“As holiday lights brighten the season, and national economic indicators including jobs reports, stock market increases and early holiday spending offer cheer, consumer confidence rose this month for the first time since May,” Dr. Doug Lonnstrom, Siena Research Institute's founding director said in the release.

“Good news, but hold your reindeer. Although we see confidence gains among Democrats and older New Yorkers, the overall willingness to spend remains well below the point at which optimism simply equals pessimism and the index is nearly five points under where the state’s confidence was this time last year," said Lonnstrom. "New Yorkers continue to be more pessimistic about the current financial landscape than the rest of the country but are more, albeit not very, positive about the future than the nation."

New Yorkers are also feeling the squeeze on core goods. Check out the graphic below--people are struggling at levels not seen since the depths of the Great Recession, according to Siena:

Assembly Minority Leader Kolb not on board with Cuomo tax plan

Wednesday, December 07, 2011

Elected officials, by and large, came out in support of the tax plan deal between Governor Andrew Cuomo, Senate Majority Leader Dean Skelos, and Assembly Speaker Sheldon Silver.

Assembly Minority Leader Brian Kolb was not one of them. The upstate Republican blasted the measure as a tax hike, done behind closed doors and as a distraction from the issues New Yorkers needed real relief from:

From what has been reported in the media so far, the bottom line is that taxes are being raised in New York State and we are still not dealing with our state’s serious spending problem. There is still no significant unfunded mandate relief for local governments. We should be protecting taxpayers by capping local Medicaid costs, enacting a state spending cap and doing this through an open, public process where these issues are debated and discussed in the light of day, not through secret deals behind closed doors by three-men-in-a-room. Tax hikes have never been the answer for creating more private sector jobs and long-term prosperity for New Yorkers. That still holds true today.

All five potential NYC Mayoral candidates laud the tax reform package

Tuesday, December 06, 2011

Council Speaker Christine Quinn:

I praise Governor Cuomo and the leaders of the Senate and Assembly for joining together to forge a strong and, most importantly fair plan, that will help close the budget gap and put our state in a better financial position.

Comptroller John Liu:

I applaud Governor Cuomo, Senate Majority Leader Skelos, and Assembly Speaker Silver for their leadership on this important issue and look forward to reviewing the proposal further.

Public Advocate Bill de Blasio:

By putting in place a fairer tax structure, Governor Cuomo and State legislative leaders have shown, in contrast to the gridlock in Washington, that by working together we can find solutions to the problems facing our state and nation.

Manhattan Borough President Scott Stringer:

I am gratified that New York state lawmakers worked together and agreed on a plan to boost our economy, unlike those in Washington D.C. who continue to be paralyzed by political gridlock.

2009 Democratic Mayoral candidate Bill Thompson:

I applaud the Governor and the legislature for their vision and leadership in making sure our state's tax structure is appropriately adjusted to meet these difficult financial times and support New York's economic recovery.

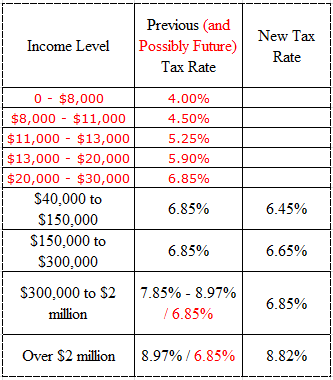

'So did the Governor really avoid a millionaires' tax' and other questions

Tuesday, December 06, 2011

Update: Well, turns out those confusing numbers was so for a reason. The numbers released by the Cuomo administration are in fact for joint filers--not single filers like I wrote. So take those numbers and halve them if you're feeling as a single person in NY. More tomorrow.

While Governor Andrew Cuomo and legislative leaders are crowing about the big-picture tax and economic stimulus package they've agreed to (the chambers still have to vote on it), there remain some questions.

First of all, did the Governor really keep/break his promise to a) not raise taxes or b) let higher income earners off the hook? It depends on how you look at it.

I grabbed some numbers Jimmy Vielkind put together earlier and added the newest numbers coming from Albany. These are the new tax brackets and the old, individual tax brackets. I'm assuming for now the new brackets are just for individuals--but that is an assumption. It appears that's the case, but it wasn't specifically mentioned when the numbers were announced and no one from the Governor's office has called back to verify.

Moving along, the answer to the above question depends, of course, on where you sit. If you accept the Governor's method below, the current taxes as of today are what we should all be paying attention to--not the ones that were set to return in three weeks. Your numbers are the ones in black, and if you're a tax payer anywhere in the tax bracket you get a break--assuming that there's no taxes for those making under $40,000 a year. Again, that's what reports indicated, but nothing specifically was said in the release, the Governor's office hasn't called, etc.

But, if you saw the expiration of the upper-income surcharge as a tax break for those making more than $300,000 a year, then the Governor's not entirely keeping his word on taxes or the millionaires' tax. Your numbers are in red.

Of course, these taxes are set to raise $2 billion, leaving the Governor to find another $1.5 billion to cover the gap next year. And if you were in favor of the extension of a millionaires' tax andthe estimated $5 billion it could bring to state coffers, you're seeing $3 billion in revenues for schools or jobs or whatever your angle was go out the window.

It all depends on where you sit.

Cuomo on reaching a tax deal

Tuesday, December 06, 2011

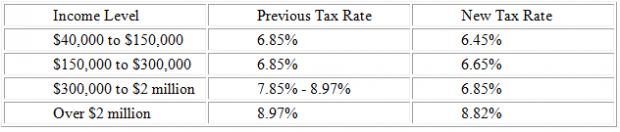

Cuomo, Skelos and Silver agree to tax reform package

Tuesday, December 06, 2011

Governor Andrew Cuomo's office has announced a deal has been reached with Senate Majority Leader Dean Skelos and Assembly Speaker Sheldon Silver to, among a series of proposals, reform New York State's tax code, resulting in nearly $2 billion in revenue for the state.

"Our state government has come together in a bipartisan manner to create jobs, grow our economy and, at the same time enact a fair tax plan that cuts taxes for the middle class," the Governor said in a three-way joint statement. "This would be lowest tax rate for middle class families in 58 years. This job-creating economic plan defies the political gridlock that has paralyzed Washington and shows that we can make government work for the people of this State once again."

The proposal would create new income brackets for people who earn $40,000 a year or more (those below $40,000 would pay no taxes):

"Assembly Democrats share the Governor's belief that we need to restore fairness and equity to our tax system - someone who makes $50,000 should not be paying the same tax rate as someone making $5 million," Silver said in the same statement.

"Assembly Democrats share the Governor's belief that we need to restore fairness and equity to our tax system - someone who makes $50,000 should not be paying the same tax rate as someone making $5 million," Silver said in the same statement.

As part of the deal, the MTA payroll tax would be decreased for small businesses, saving them an estimated $250 million. The shortfall in revenues would be picked up by the state.

An agreement was said to be reached on support for a state constitutional referendum on gambling.

The proposal would also create a new infrastructure fund to funnel billions into improving the state's bridges and roads, as well as water, parks and educational facilities.

Another proposal also includes a inner city youth program that would give tax breaks to employers who hired unemployed youth, as well as a $37 million training program.

Areas hit hard by storms earlier this year would be eligible for a new $50 million grant program. There would also be a job retention credit for businesses to stay in flood damaged areas. Manufacturers in the state are also being promised a lower tax rate.

Details emerge on Cuomo's tax reform package

Tuesday, December 06, 2011

Details are still emerging on Governor Andrew Cuomo’s tax overhaul that state legislators are expected to review either later this week, or early next. But the basic elements of an agreement, according to news reports, appears to have been reached.

The assiduous Nick Reisman at Capital Tonight reports that the administration will seek to expand the tax breaks to five new ones. Upper-income earners will get relief from the upper-income “millionaires’ tax” surcharge, but will pay more than what they would if rates were to reset to pre-surcharge levels at the end of the month. Middle income earners will, according to a number of reports, be looking at a tax cut.

According to Reisman, the new brackets would be:

- $40,000 and below

- $40,000 to $150,000

- $150,000 to $300,000

- $300,000 to $2 million

- $2 million and higher

Jimmy Veilkind at the Times-Union has a great review of current and potential tax brackets here, just as a reference. The tax plan would raise an estimated $1.9 billion for the state, which isn’t quite enough to fill that $3.5 billion hole Cuomo expects next year.

The economic package, as the Governor is pitching it, would also include some non-tax pieces according to Ken Lovett of the Daily News:

WFP says Cuomo can prove he's not Governor 1% with tax overhaul

Tuesday, December 06, 2011

The Working Families Party is signaling its support for Governor Andrew Cuomo’s tax reform plans. Dan Cantor, the labor-backed political party’s executive director, said he felt the proposal was moving things in “a good direction.”

“It’s important that the tax reform package produce enough revenue,” Cantor said. “The $5 billion in the millionaires’ tax expiration, if it produces that much, it will allow us to both close the budget deficit, reverse some of the cuts and, more importantly as the Governor has pointed out, make these investments in jobs and growth.

“This is a chance for the Governor and the legislature to show that government is not controlled by the one percent.”

WFP has been a proponent of continuing a tax on higher income earners that’s set to sunset at the end of this month. But Cantor said this doesn’t indicate a reversal on the so-called millionaires’ tax for the Governor.

“Facts on the ground change, and people are correct to change their views when facts change,” said Cantor. “The fact is that the unemployment crisis is so enormous, both to individuals and whole communities, that something has to be done.”

'The Capitol Pressroom' with Susan Arbetter

Tuesday, December 06, 2011

Today on "The Capitol Pressroom":

Today on "The Capitol Pressroom":

JCOPE, or the Joint Commission on Public Ethics is slated to rev up by Monday December 12th. It’s Albany’s latest iteration of legislative and lobbying oversight, designed to replace the CPI – the Commission on Public Integrity, but to also have power over state lawmakers. Before JCOPE, and before CPI, there was the State’s Temporary Commission on Lobbying headed up by ethics gadfly David Grandeau. Today Grandeau offers up his assessment of JCOPE’s future, and discusses Albany’s ethical challenges starting with the recently acquitted Assemblyman William Boyland.

Can Cuomo do what Washington can’t? Bring a bipartisan group together to raise taxes? And what are the political pros and cons of a Special Session? Around which issues will the legislative leaders be tangling? We have a lot of questions today for Bruce Gyory, a Democratic strategist with Corning Place Consultants, former advisor to three governors as well as a political science professor at the University at Albany, and the former senior vice president at the Empire State Development Corporation. He'll be joined by Pataki communications director and adviser Dave Catalfamo, a 20 year veteran of New York State government now with Capitol Public Strategies.

Assemblyman Camara lauds Cuomo for 'exercising leadership' on tax reform

Monday, December 05, 2011

The chair of the bicameral Black, Puerto Rican, Hispanic and Asian Legislative Caucus, Assemblyman Karim Camara of Brooklyn he was "very optimistic" about what he called "a great plan" to overhaul the tax code put forward in broad strokes by Governor Andrew Cuomo this weekend.

"For the last several months we were talking about having a tax code that was more equitable, having a level of what many of us described as fairness, lessening the burden on the middle class--those are all critical priorities," Camara said, speaking for only himself as the Caucus has yet to take an official position on the tax reformers. However, its members have been some of the most vocal in criticizing the Governor over his refusal to extend the so-called millionaires' tax.

The Assemblyman said Cuomo was not going back on his word on taxes, despite the criticism some are leveling against him.

"Some people may call it going against what he said before, etcetera, etcetera. But I look at it as, you assess the situation, you make the best decision for the state at this point at this time," said Camara. "I think he should be commended for showing that leadership."

Tea Party group's co-founder calls Cuomo's tax plan 'smoke and mirrors'

Monday, December 05, 2011

One of the co-founders of a major Tea Party group in New York isn't buying into Governor Andrew Cuomo's tax overhaul proposal. Thomas Basile of Tea Party 365, who formerly served as the executive director of the state's Republican Party, said the Governor wasn't focusing his attention in the right areas.

"Whenever you hear the Governor use words like 'fair' and 'progressive,' those are code words for raising revenue," Basile said. "Raising revenue means raising taxes. If the Governor were really serious about job creation, which is the pretense for making these changes, he would be making good on his promise, one, not to raise taxes and, two, to reduce government spending."

Basile said the Governor, who has retained relatively good poll numbers among conservative voters, could expect Tea Partiers throughout the state to take notice.

"The Tea Party members around the state are going to see this for what it is, and that is as an effort for the Governor to shirk his responsibility to reduce the scope and size of government in favor of raising taxes and burdening high income earners," said Basile. "Ultimately that increased tax burden is going to be passed along to the middle class as well, regardless of what the politicians say."

Governor Cuomo's op-ed on tax reform

Monday, December 05, 2011

The following was sent to newspapers for publication across the state:

New York needs to enact a bold, innovative economic plan and tax code reform to create jobs at this difficult time. To achieve that we will need bipartisan political cooperation and a plan the people of the State support.

I believe economic development, popular support, and political consensus must all be built on the same foundation: fundamental fairness.

Last year, when we were preparing the state budget, I exposed that the system was inherently biased against the taxpayer. The very definition of the State's budget deficit included statutory annual increases for individualized programs marbleized through the State's budget laws. In short, "deficit" meant the amount necessary to fund a 13 percent increase. The taxpayer didn't have a chance.

Our current tax system is also unfair.

I have posed the following question to Albany veterans, befuddling almost all: at what income level does the State's top personal income tax rate become effective? Answers range from about $100,000 to $1 million. Virtually no one guesses the correct answer: only $20,000 for an individual taxpayer; and only $40,000 for a two-earner family. So, in New York under the permanent tax code, an individual making a taxable income of only $20,000 pays the same marginal tax rate as an individual making $20 million. It's just not fair. While New York's earned income tax credit, child care credit, and high standard deduction help working poor families, New York has left the middle class with an undue burden which also hinders our economic recovery.

On-air on WNYC--gentrification and the black vote in NYC

Monday, December 05, 2011

I got the chance to appear on WNYC today talking about my piece on the decline in the black population in New York City and how it's playing out in the 11th Congressional District as we move through the redistricting process.

Not everyone agrees with my analysis. Over at Room Eight, one of the first real New York political blogs, the blogger Gatemouth took me to task for what he saw was misleading stats in my post. I responded to his critique, pointing out that he really didn't disagree with my stats or my ultimate analysis, just the diagnosis--gentrification--of why the Voting Rights Act-protected11th was increasingly less black.

Conservative Party Chair Mike Long says Cuomo 'lost his will' on taxes

Monday, December 05, 2011

Not everyone's pleased to hear Governor Andrew Cuomo's discussion about a tax overhaul. Conservative Party Chairman Mike Long, for one, made it clear some of the concession talk that could result in changes to rates on higher income earners was unwelcome.

"It appears that he lost his will to stand up to special interests," Long said, identifying those special interests as unions and their supporters in the Assembly. "I have been lauding him all year for doing what I believe is the right thing for the citizens of New York. You raise taxes, you lose jobs, and I don't care how small or big, it just takes away from New York's roof."

Long said he was "in the midst" of discussions with Senate Republicans about their plans when and if a special session is called later this week. He said his hope was they would oppose the plan.

"What other purpose are they there for," Long asked. "Hopefully they can't come up with an agreement."

Kathryn Wylde on why big biz in NYC can support Cuomo's tax overhaul

Monday, December 05, 2011

Speaking on behalf of the Partnership for New York City Kathryn Wylde,the group's president, laid out the argument on the Brian Lehrer Show this morning for contingent support from the city's big business community for the initial details of Governor Andrew Cuomo's forthcoming tax overhaul.

The support is a reversal of sorts for the Partnership, which had been bitterly opposed to the continuation of the so-called millionaires' tax on higher-income earners that's set to expire at the end of the month. Now, Wydle says Cuomo's approach, which would reportedly keep upper income rates higher than what they'll be after the sunsetting, is balanced approach her membership can live with.

"He is proposing, 'Let's relook at our overall spending and tax program, and see what we can do together to even things out,'" Wylde said on the show. "If we take that measure we can accept revenue increases coming out of, whether it's reducing tax loopholes or temporarily raising rates, there has to be a transition to longer-term fiscal responsibility."

'The Capitol Pressroom' with Susan Arbetter

Monday, December 05, 2011

Today on "The Capitol Pressroom":

Today on "The Capitol Pressroom":

Two views on the Governor’s tax reform plan featuring Siena adjunct professor David Liebschutz formerly of CGR, and then, the Manhattan Institute’s EJ McMahon weighs in.

Albany Bureau Chief Ken Lovett of the NY Daily News will have political analysis.

Adam Lisburg, Editor of the newly merged City & State (www.cityandstateny.com)

Legislators back in Albany this week as Cuomo lays out tax plan

Monday, December 05, 2011

Last week the State Assembly announced it would be conferencing tomorrow as it prepared to come back into session. State Senate Republicans plan to return on Wednesday to, as Scott Reif, spokesperson for the Majority put it, "discuss a number of issues, including our commitment to cutting taxes to create new private sector jobs."

All this adds up to the legislature likely starting a special session as the end of this week, and the agenda will likely be Governor Andrew Cuomo economic plan that will include major changes to how New Yorkers at various levels are taxed.

In an op-ed released over the weekend, the Governor offered a broad set of goals he said would "address the illness" facing the state's economy. The creation of a fund to help rebuild the state's infrastructure, the creation of "gaming locations" (you might know them as casinos) in New York State, and a targeted focus on urban youth employment issues were among the top of Cuomo's list of to-dos.

But what the legislature and Governor will likely be most focused on in the immediate future will be an overhaul of the tax code.

"[A]n effective way to stimulate the economy and promote job creation is through our tax system," Cuomo wrote. "We should pursue comprehensive reform of our tax code to make it fair, affordable and one that incentivizes economic growth."